child tax credit monthly payments continue in 2022

The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

As it stands right now child tax credit payments wont be renewed this year.

. IR-2021-153 July 15 2021. This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than. The law authorizing last years monthly payments clearly states that no payments can be made.

The final round of monthly advanced Child Tax Credit payments went out on December 15. The pay increase is equivalent to over 45000 per year for a full-time worker. However there is still a portion of the expanded credit that qualifying families.

The 2022 child tax credit is set to revert to 2000 for each dependent age 17 or younger. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. Half of the credit - 1800 or.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. 15 but doubts arise around the remaining amount that parents will receive when they.

Ad Discover trends and view interactive analysis of child care and early education in the US. However parents might receive one more big payment in April 2022 as part of last years plan. Get the up-to-date data and facts from USAFacts a nonpartisan source.

15 Democratic leaders in Congress are working to extend the benefit into 2022. In 2021 President Biden expanded the child tax credit from 2000 to 3600 and let families collect monthly payments in advance. Get Your Max Refund Today.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Staff Report March 14 2022 517 PM. Now even before those monthly child tax credit advances run out the final two payments come on Nov.

President Joe Bidens Build Back Better Act extends the expanded Child Tax Credit which is currently being paid in monthly installments through the end of 2022. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The payments wont continue in 2022 for the new year.

The enhanced CTC payments were originally included in the American Rescue Plan to help families through the pandemic as previously reported by GOBankingRates. Remains opposed to both the size of the bill and the idea of extending the monthly. The monthly Child Tax Credit payments that were issued to millions of American families helped to reduce child poverty by more than 40 last year according to reports.

Bank of America plans to continue raise the minmum it pays employees to 25 an hour by 2025 US. The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

The advance is 50 of your child tax credit with the rest claimed on next years return. You see monthly payments started arriving. These payments were part of the American Rescue.

Food insufficiency rates. Democrats in support of extending the monthly Child Tax Credit payments on Tuesday pushed back on the idea of work requirements but said they continue to engage with. Child tax credit payments will continue to go out in 2022.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

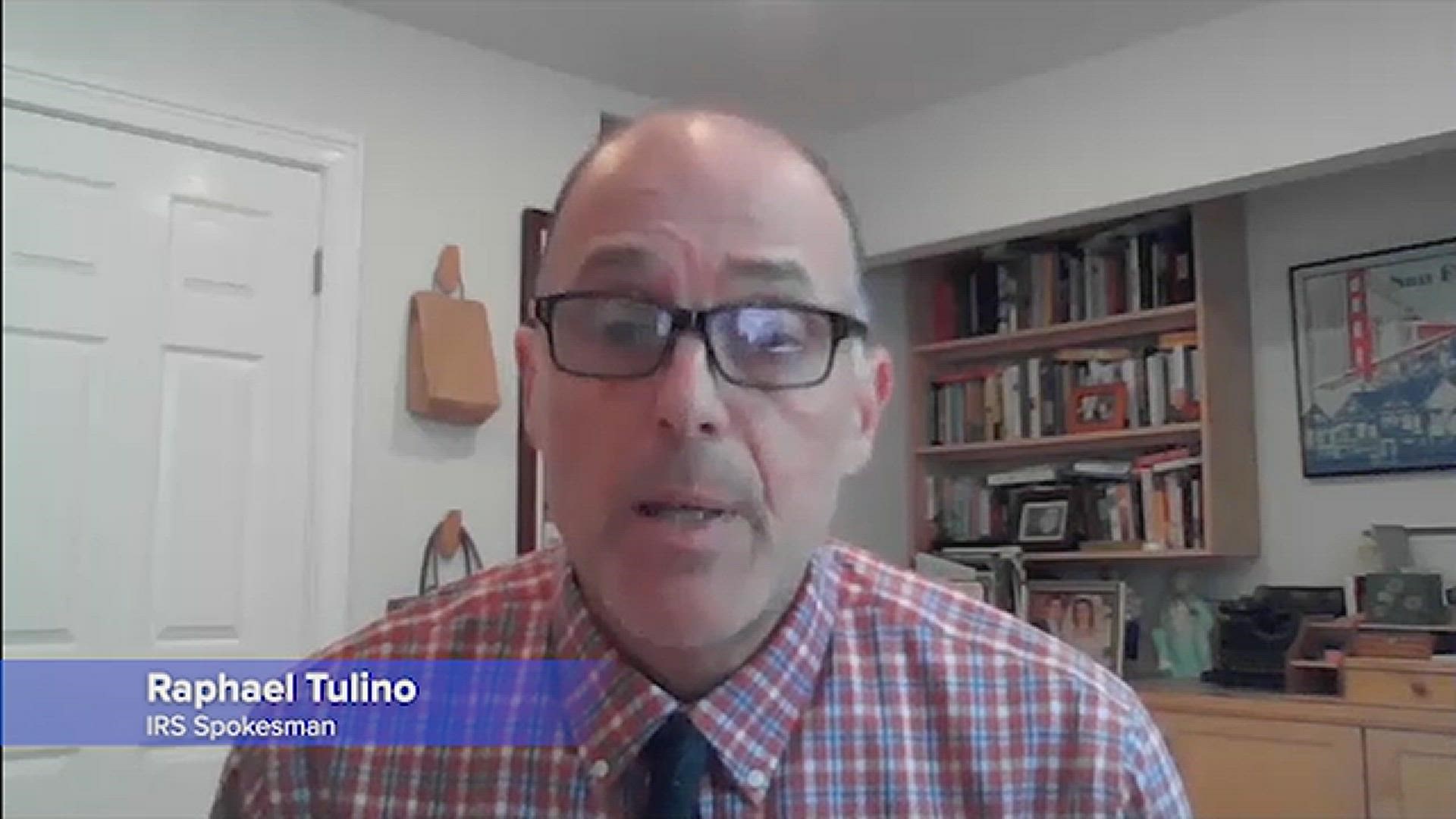

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Will Monthly Child Tax Credit Payments Be Extended Into 2022

Child Tax Credit Is Expanded Child Tax Credit Dead Did It Help Deseret News

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Household Monthly Budget Spreadsheet Budget Calculator Monthly Spending Tracker Monthly Budget Spreadsheet Budget Calculator Budget Spreadsheet

Dave Ramsey S 7 Baby Steps Infographic Money Finance Dave Ramsey Dave Ramsey Plan Ramsey

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

Families Aren T Getting Child Tax Credit Checks For First Time In 6 Months

Child Tax Credit When Will Monthly Payments Start Again Fingerlakes1 Com