south dakota sales tax online

With local taxes the. In addition to the sales tax cities can levy a 2 municipal sales and use tax and a 1 municipal gross receipts tax on certain goods and services.

Fillable Sd Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

The state sales tax rate for South Dakota is 45.

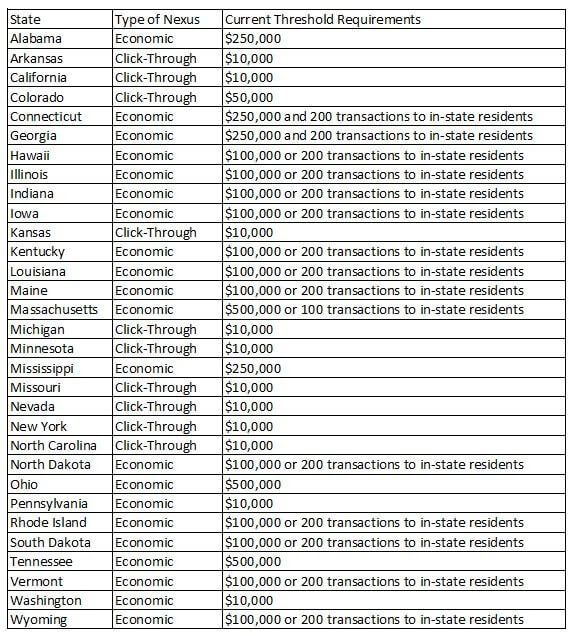

. Having a certain amount of economic activity in South Dakota could trigger nexus under Senate Bill 106 which creates a tax obligation for out-of-state sellers meeting one of the following. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. 31 rows The state sales tax rate in South Dakota is 4500.

The South Dakota sales tax and use tax rates are 45. SPRINGFIELD This weekend is the last opportunity for Illinoisans to avoid paying sales taxes while shopping online even though the practice has technically been illegal for. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission.

Skip to main content. If the market pays the sales tax the seller will no longer have to pay the tax for sales through that marketplace. The marketplace will pay sales tax if the threshold is met.

The renewed push comes after more than a decade in which states have tried to get Congress to consider a national law that would require online retailers to remit a sales tax. The South Dakota Department of Revenue is your online resource for taxes motor vehicle administration audit information and much more. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

South Dakota Tax Application. It also applies to the sale of services and. What Rates may Municipalities Impose.

Therefore the South Dakota sales tax is imposed on gross receipts of all retailers including the lease and sale of real or tangible personal property. South Dakota has 142 cities counties and special districts that collect a local sales tax in addition to the South Dakota state sales taxClick any locality for a full breakdown of local. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Most services in South Dakota are subject to sales tax with some exceptions in the construction industry. Tribal governments may also. This license will furnish your business with a unique sales tax.

Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. Enter your UserName and Password to log into the. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum. Several examples of of items that exempt from South. For more information on excise.

Internet Sales Tax Definition Types And Examples Article

South Dakota V Wayfair Collecting Sales Tax From Online Sales

Sales Tax Changes Are Imminent For Online Retailers Fortiviti

Economic Nexus And South Dakota V Wayfair Inc Avalara

Fillable Online State Sd Sales Tax Return State Of South Dakota State Sd Fax Email Print Pdffiller

South Dakota Preps Online Sales Tax Fight For Scotus Courthouse News Service

Americans For Prosperity Files Ballot Measure Proposal To Lower South Dakota Sales Tax Mitchell Republic News Weather Sports From Mitchell South Dakota

How To File And Pay Sales Tax In South Dakota Taxvalet

Home South Dakota Department Of Revenue

South Dakota Department Of Revenue Facebook

How To File And Pay Sales Tax In South Dakota Taxvalet

Supreme Court Widens Reach Of Sales Tax For Online Retailers The New York Times

Taxjar To Host Free Webinar June 27 Tax Experts Answer Questions On State Tax Compliance For Online Stores Wp Tavern

No Matter How The Supreme Court Rules Don T Bank On An Online Sales Tax Boom Route Fifty

Historical South Dakota Tax Policy Information Ballotpedia

South Dakota V Wayfair How A Supreme Court Case Is Revealing A 26 Year Old Congressional Dormancy Regarding Interstate Online Sales Tax Roosevelt Institute Cornell University

One Year Later 40 States See Sales Tax Fairness

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue